Case Study #1: Rent vs. Buy Analysis

Scenario Overview

Goal: Evaluate the long-term net worth impact of renting vs. buying a $1M home.

Time Horizon: 10 years

Investment Growth Assumption: 8% annually

Home Appreciation Assumption: 4% annually

Mortgage Rate: 6.75% (30-year fixed)

Option 1: Purchase a $1M Home

- Down Payment: $200,000

- Mortgage Loan Amount: $800,000 @ 6.75% (30yr fixed)

- Future Home Value: ~$1,480,244

- Remaining Mortgage Balance (after 10 yrs): ~$688,658

- Home Equity: ~$791,586

- Invested AUM ($200K at 8%): ~$431,035

- Total Net Worth: $1,229,621

Option 2: Rent at $4,000/month

- Rent Payments: $4,000/month x 120 months = $480,000 spent on rent

- Invested AUM ($400K at 8%): ~$863,570

- Total Net Worth: $863,570

Strategic Conclusion

- Option 1 (Buy) results in $366,051 higher net worth over 10 years.

- Buying builds home equity while allowing investment growth.

- A split strategy of real estate + AUM compounding drives superior outcomes.

Disclaimers & Compliance Notes

This analysis is for illustrative purposes only. Individual results will vary based on market performance, tax considerations, and lending qualifications. Consult your financial advisor and mortgage professional before implementing any strategy.

Case Study #2: Move-Up Buyer

Scenario Overview

- Current Home Value: $1,500,000

- Net Proceeds After Sale: $1,000,000

- New Home Purchase: $2,000,000

- Mortgage Terms: 30-year fixed @ 6.375%

- Assumed Investment ROI: 8% annually

- Property Appreciation: 4% annually

Option 1: Sell & Buy with $1M Down (50%)

- Down payment: $1,000,000

- Mortgage: $1,000,000 @ 6.375%

- Remaining investable assets: $0

10-Year Net Worth Projection: - Future home value: ~$2,960,000 - Remaining mortgage balance: ~$866,000 - Net worth (home equity): $2,115,403

Option 2: Buy with 20% Down, Invest Excess Equity

- Down payment: $400,000 (20%)

- Mortgage: $1,600,000 @ 6.375%

- Invest excess equity: $600,000 @ 8% ROI

10-Year Net Worth Projection: - Future home value: ~$2,960,000 - Remaining mortgage balance: ~$1,385,000 - Investment future value: ~$1,295,000 - Net worth (equity + investments): $2,940,135

Strategic Conclusion

- Option 2 results in ~$824,732 higher net worth over 10 years.

- Maintains liquidity, diversification, and tax efficiency.

- Aligns mortgage strategy with long-term financial growth.

Disclaimers & Compliance Notes

This analysis is for illustrative purposes only. Individual results will vary based on market performance, tax considerations, and lending qualifications. Consult your financial advisor and mortgage professional before implementing any strategy.

Case Study #3: Vacation Home vs AUM

Scenario Overview

Vacation condo purchase: $1,350,000

Option 1: Liquidate $1,350,000 from AUM earning 8% annually to buy condo in cash

Option 2: Refinance existing investment property ($2,700,000) for $1,350,000 cash-out, buy condo with $450,000 down and $900,000 mortgage at 6.375%, keep existing AUM fully invested and invest additional proceeds.

Option 1: Liquidate AUM to Buy Condo in Cash

- AUM growth lost: ~$2,996,514 (no longer invested)

- Vacation condo value after 10 years: ~$2,000,000

- Investment property value after 10 years: ~$4,000,000

Total Net Worth: $5,994,990

Option 2: Refinance, Purchase Condo with Mortgage, Keep & Grow AUM

- AUM future value (total): ~$4,994,190

- Vacation condo net equity: ~$1,199,723

- Investment property net equity: ~$2,855,793

Total Net Worth: $9,049,706

Strategic Conclusion

- Option 2 results in ~$3,054,716 higher net worth over 10 years.

- Uses strategic leverage to preserve investment growth while maximizing property equity.

Disclaimers & Compliance Notes

This analysis is for illustrative purposes only. Individual results will vary based on market performance, tax considerations, and lending qualifications. Consult your financial advisor and mortgage professional before implementing any strategy.

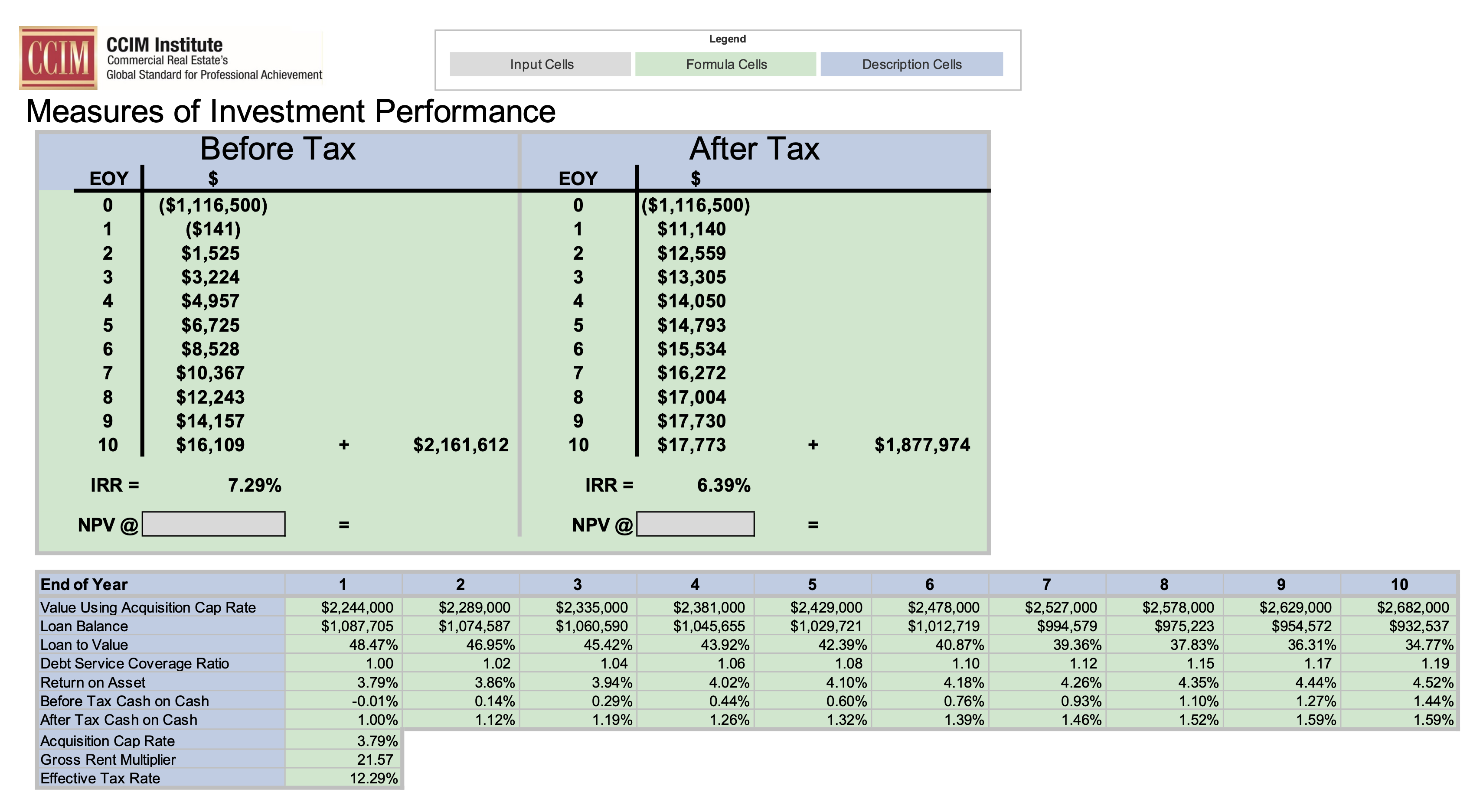

Case Study #4: Investment Property Leverage Strategy

Scenario Overview

Goal: Evaluate the IRR and long-term return impact of leveraging a debt-free investment property.

Option 1: Hold Investment Property Debt-Free

- Current Property Value: $2,200,000

- Debt: None

- Net Monthly Cash Flow: $7,610.83

- Annual Cash Flow: ~$91,329.96

- Internal Rate of Return (IRR): 6.88%

- Net Worth at the end of 10 Years $3,256,537

Option 2: Cash-Out Refinance & Invest

- Loan Amount: $1,100,000 @ 6.5% (30-year fixed)

- Use refinance proceeds to invest in AUM at 8% annual return

- Internal Rate of Return (IRR), Pre-Tax: 7.27%

- Internal Rate of Return (IRR), After-Tax: 6.33%

- Net worth after 10 years property $2,324,000 + AUM $2,441,604 = $4,765,604

- Additional Net worth of $1,509,067

Strategic Conclusion

While Option 1 provides stable and predictable returns with a decent IRR of 6.97%, Option 2 unlocks liquidity and enables growth through reinvestment. It slightly increases the pre-tax IRR to 7.27%, though the after-tax IRR may dip to 6.39%.

This strategy works well for clients prioritizing liquidity, increased AUM growth, or who are open to managed leverage within a coordinated financial plan.

Disclaimers & Compliance Notes

This analysis is for illustrative purposes only. Individual results will vary based on market performance, tax considerations, and lending qualifications. Consult your financial advisor and mortgage professional before implementing any strategy.